One of the most confusing parts of peer to peer lending since its inception is the tax reporting of income and losses, especially the charged-off loans we all experience. While I am certainly not a tax expert, I would like to share how I am reporting my charged-offs loans with Lending Club on my 2013 tax return. As a note, the same process will apply to my Prosper account; however I didn’t have any charged-off loans in 2013.

Year-End Charged-Off Loans Reporting Information

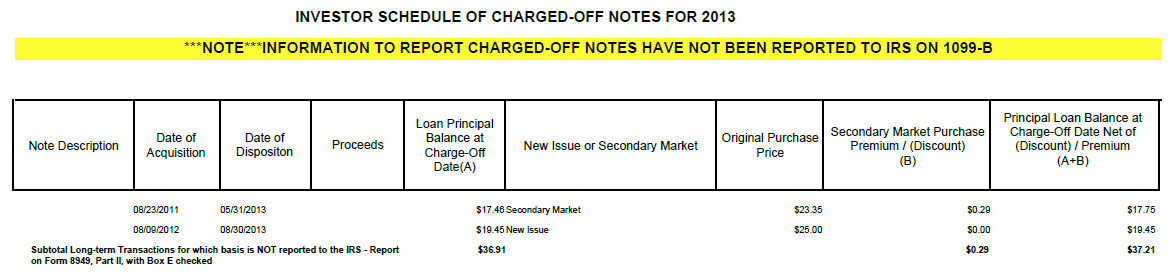

Unlike in 2012, Lending Club has provided a nice summary of your taxable account’s charge-off information in the Investor Schedule of Charged-Off Notes For 2013. As I addressed in my Lending Club Tax Guide post, this information is a summary of several key details for charged-off loans, and everything needed for tax filing purposes. The list below shows everything that the charged-off notes statement has to offer:

- Date of sale (charged-off date)

- Date of acquisition

- Loan principal balance at charged-off date

- Whether the note is a new issue or secondary market acquisition

- Original purchase price

- Premium or discount from secondary market acquisition

- Principal balance net of secondary market premium or discount

Knowing what information on the schedule is important, but seeing it is also helpful. Below is a snapshot of my Investor Schedule of Charged-Off Notes For 2013 that shows the information for the two loans I had that were charged-off in 2013.

Reporting My Charged-off Loans

Given the information in the screen shot above, it is a fairly simple process to report the two notes that were charged off. When reporting this information, you can either summarize the information and attached a copy of the supplemental schedule as a support or report each charged-off loan individually. Of course, since I only have two charge-off loans from 2013, I will be reporting these individually.

The loss from charged-off loans gets reported on Form 8949 – Sales and Other Dispositions of Capital Assets. After all of your inputs are recorded, they are totaled, these losses are then carried to Schedule D – Capital Gains and Losses which flows onto the front page of your personal return, form 1040. As individual filers, you are limited to $3,000 worth of capital loss deductions in excess of capital gains.

So, on my return, I’ve input both charged-off loans separately, with the outstanding principle balance net of the (discount)/premium as the cost basis and the proceeds as zero. The date of acquisition and disposal are fairly self-explanatory. Lastly, as both were long-term assets (over a year-old at time of disposal) they both appear on page 2 of Form 8949 in Part II, designated for Long-Term reporting.

A copy of the filled out Form 8949 is below (note: this also shows the reporting of the recoveries Lending Club made on my behalf):

I hope that helps those interested in how to report any charge-offs experienced in 2013. As I said before, I am not a professional tax advisor, and would encourage you to discuss your personal tax situation with your own tax advisor.

As some are likely to point out, there is a major discrepancy in how investor’s report income and take losses. Under the current scenario, interest income is reported and recognized as ordinary income and subject to a taxpayer’s marginal tax rate, which ranges from 0-43.4% (includes potential net investment income tax). However, losses from charged-off loans can only be deducted as capital losses and are capped at $3,000 per year in excess of capital gains. For investors with very large investments in taxable accounts, there is the potential to lose the ability to capture losses under a normal individual filing scenario.

Additionally, capital losses in effect only offset capital gains, which are taxed at a maximum of 23.8% (includes potential net investment income tax). This clearly is a discrepancy in the taxation of income and losses from the same investment, however these are the tax laws we currently operate under. The tax considerations are absolutely something to consider when investing in peer to peer lending and looking at your overall returns and risk profile. In many cases, this supports the idea that the preferred means of investing in Lending Club or Prosper is through tax-deferred accounts such as an IRA.

You can check out my Lending Club and Prosper accounts on their respective pages (linked).

Awesome information WYOR. Can you ballpark the annualized return you’re getting on Lending Club notes? Are you sure you don’t want to put together a “how to” or tutorial on these things?!

-Bryan

Bryan, you can find my return figures for both Lending Club and Prosper at their respective pages (linked). Let me know if you have any questions.

Perhaps down the road, however, at this point I don’t have any plans for putting together a tutorial or how-to guide. Thanks for stopping by!

W2R,

This is really interesting. I did not have any charge-off this year at Lending Club. But next year I’ll be likely to. Seems not too complicated, only adding a F8949 to the Sch D. Thanks for the info.

-RBD

No, it really isn’t too complicated in my opinion. This biggest outstanding issue is the tax treatment of the income versus deductibility of the losses.

Appreciate your comment and stopping by RBD!

I used turbo tax to file my taxes this year and discovered LC is very simple. I thought there would be more to it… The only annoying part is that the income is fully taxable! Anyways I haven’t had to deal with charge offs yet, if a note doesn’t pay I simply sell it on the secondary market. I had to sell one a few days ago in fact.

Not sure if selling delinquent notes is the best strategy or not. Might be a good topic for a post if you have any ideas on the matter.

Reporting the interest income is very simple. Charge-offs aren’t too far behind when it comes to simplicity. Of course given that you are selling notes, you add some gains/losses to the mix, but otherwise the biggest challenge is that the income and losses do not match during tax reporting. Ordinary income versus capital losses. Hopefully as P2P lending grows, further guidance and tax treatment considerations should come out.

Thanks for stopping by CI and best of luck with your investments! I will definitely consider a post about selling late notes.

I am using Turbo Tax and I am still a little bit confused about reporting my Charge Offs in Turbo Tax. I have inserted all the 1099-B proceeds guided by TT, (which was LONG AND TEDIOUS for me). Then, I move to the last part, the Charge-Offs, and it’s a LONG LIST. 1.) Where do I put that in TT? 2.) Because it’s rather long, can’t I just summarize it?

Jack, my recommendation would be to summarize the information in both long and short term amounts. Should the IRS need the support, you have that in the form of your Lending Club tax forms. This saves time, and still allows you the ability to report you losses in the appropriate category. I hope this helps!

And the usual disclosure, I am not a tax advisor and these are only my opinions. Consult with a professional on all tax matters.

Should I automatically snail mail it in after my file submissions has been received or should I hold off until they contact me down the road? I wonder if it’s better to hold onto this attached info or send it in no matter what?

I would hold on to it and provide it down the road if they desire to see it. That isn’t something I would be too worried about sending in at this point.

Great info…looks we reported our charge offs the same. The one difference is my description was slightly different. I also included the loan number.

Certainly adding the loan number doesn’t hurt, but for me, if the IRS were to ever audit me and question my treatment, I’d just send them a copy of the summary statement and let them do the work of double checking. As long as everything in total ties, I’m comfortable with it.

Thanks for sharing your experience as well.