Lending Club’s development team has been hard at work these last couple of months pushing out various tweaks to their platform. As I mentioned in a post last month, there were changes to both the main Lending Club platform and Foliofn, the secondary market trading platform. Well the changes keep on coming, and today, a new change has been kicked out enabling investors to see where their returns are, both adjusted and unadjusted, in relation to other investors. Additionally, this morning I noticed that in my account with a balance in excess of $10,000, Lending Club added a link and has begun a year-end push for transitioning accounts to their PRIME investment service.

Lending Club’s development team has been hard at work these last couple of months pushing out various tweaks to their platform. As I mentioned in a post last month, there were changes to both the main Lending Club platform and Foliofn, the secondary market trading platform. Well the changes keep on coming, and today, a new change has been kicked out enabling investors to see where their returns are, both adjusted and unadjusted, in relation to other investors. Additionally, this morning I noticed that in my account with a balance in excess of $10,000, Lending Club added a link and has begun a year-end push for transitioning accounts to their PRIME investment service.

Lending Club Investor Return Comparisons

The most fascinating of the updates is the investor comparison page. I, like many others, love to track the performance of my peer to peer lending accounts. Striving to do better and constantly tweaking my filters and reviewing my progress is a guilty pleasure of mine. However, checking out how others are doing is equally as fascinating. Perhaps it is just my quest for knowledge, or to see who has found an edge, or just to share in the experience of those who have found success with their peer to peer investments. As there are several bloggers out there who routinely release quarterly or bi-annual updates, the opportunity to get a glimpse of others progress is available, although limited in number.

Needless to say I was quite excited when I checked my accounts this morning and the new link below my Net Annualized Return number jumped out at me. You can see the link below:

When clicking on the link you are taken to a screen that explains several things. The first, and most important in my opinion, is an explanation laying out the decline in returns as notes age. The purpose of this is to temper expectations of investors and allow them to see the downward trend in return as defaults and charge-offs occur over time. This topic of managing investor return expectations is very much needed and late in coming, and has been discussed in many forum posts and comments over at Lend Academy. While I mentioned in my post regarding the addition of adjusted NAR wasn’t a big improvement, I actually have changed direction and am all in favor of tempering the expectations of investors to be more realistic. Realistic expectations will allow for long-term legitimacy.

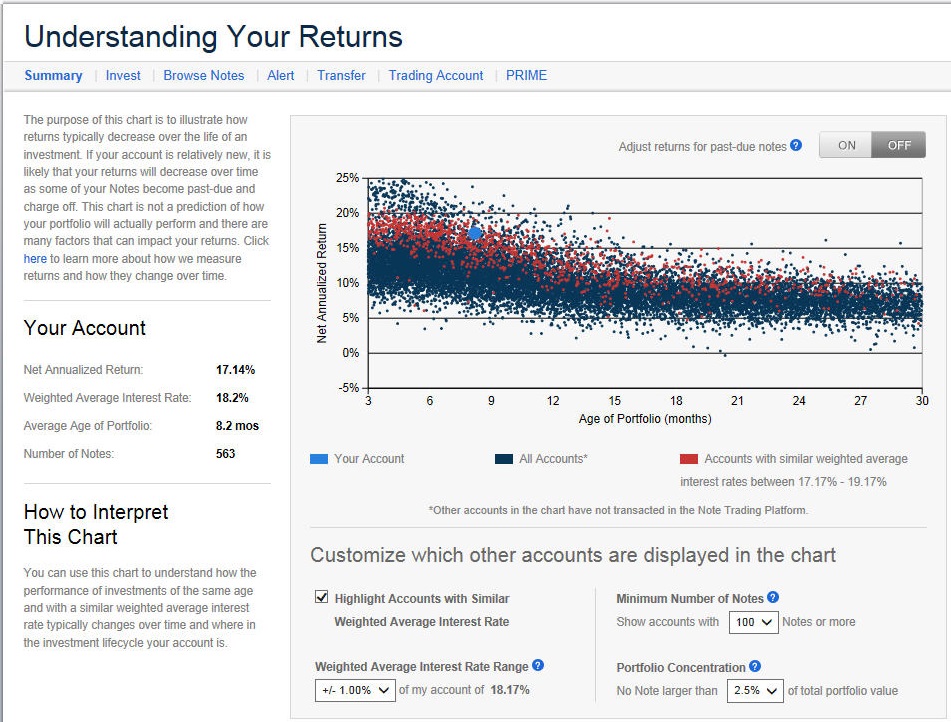

After the blurb explaining the downtrend in returns, you will see a chart of how investors who are similarly invested (highlighted in red), based on a set range of weighted average interest rate, are performing and where your account (large blue dot) stands in relation to them. Additionally, all investors with accounts meeting some basic criteria are displayed in dark blue. Below is the first screen shot of my Roth account, utilizing unadjusted return information.

Roth Account – Unadjusted NAR with Default Settings

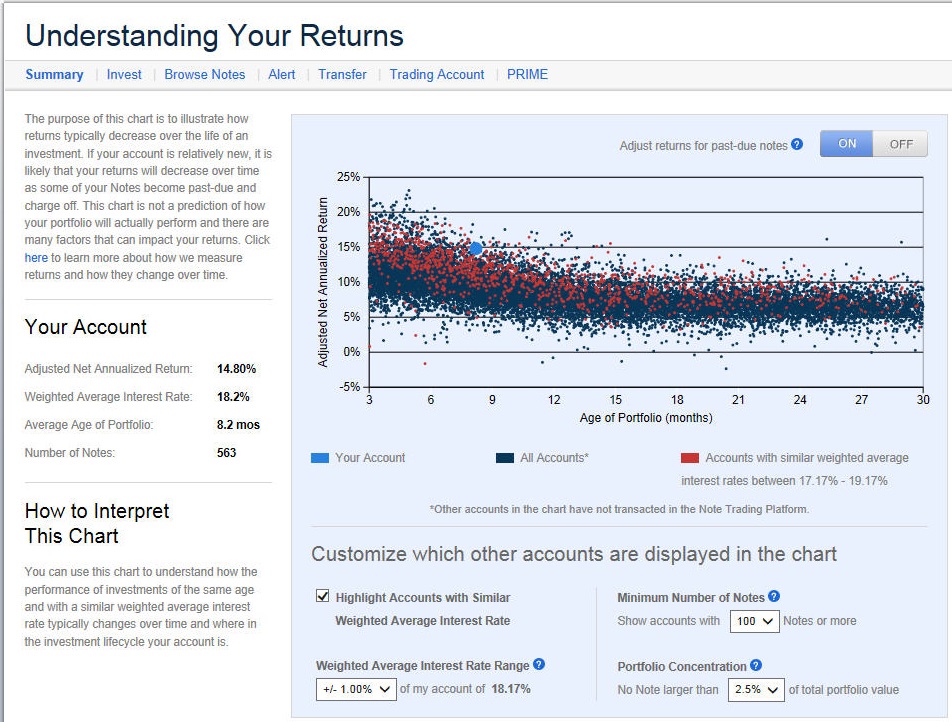

As you can see with the screen grab, you have the option to enable or disable your adjusted NAR. If you are unfamiliar with the adjusted NAR, please check out my previous post on changes to Lending Club. Below in the shot of my Roth utilizing the adjusted NAR.

Roth Account – Adjusted NAR with Default Settings

A few of other nice features of this page are the account summary, customizing the chart data, and additional components that affect returns. The account summary, as seen in the shots above, list the adjusted or unadjusted NAR, the weighted average interest rate of the account, the average age of the account, and the number of notes held in the account. I like this summary primarily for the average age of notes in the account. In order to figure this out any other way, you would generally use a third-party site like Interest Radar or NickelSteamroller.

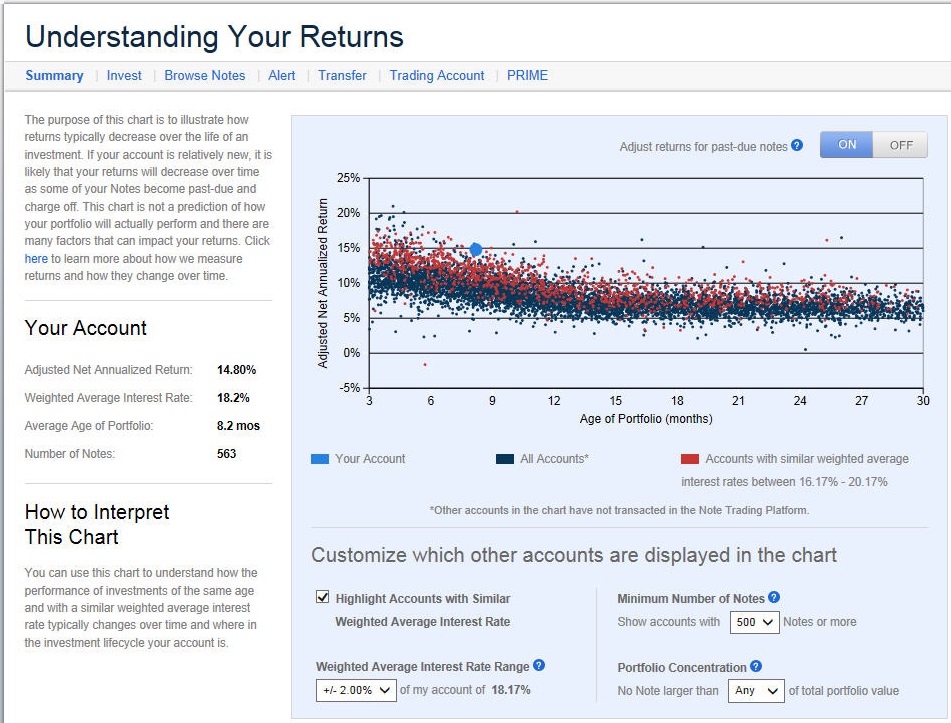

Customizing the chart data allows you to broaden or narrow the range of comparable notes that are highlighted in red, and what defines the ‘All Accounts’ in dark blue. The default settings are as follows: highlight those with similar weighted average, the weighted average interest rate with +/- 1.00%, a minimum number of 100 notes, and with no note accounting for greater than 2.5% or the total portfolio value. Just for fun I tweaked the selection to highlight those within +/- 2.00%, greater than 500 notes, and any sized notes were allowed. This updated chart is below.

Roth Account – Adjusted NAR with Customized Settings

To be clear, the two customizable items on the left appear to alter only what is highlighted in red, while the two on the right adjust the ‘All Accounts’ in dark blue.

I did not take a screen shot of the additional components as laid out by Lending Club that might affect your return, but they include the number of notes in your portfolio, concentration of your investment, the composition of your investments, as well as the buying of selling of notes in your portfolio. Both of my accounts show a note below the chart that says “Other accounts have not transacted in the Note Trading Platform,” as this can very significantly affect returns and render NAR useless. This does affect my taxable account as it lists 213 notes being in the account in the summary section, while only 123, including 43 fully paid notes, currently exist in the account. This is why I calculated my own return figures outside of Lending Club’s NAR, especially for my taxable account where I was actively trading notes for a while.

Finally, I did want to provide a link to what I believe is an updated Lending Club ‘About Net Annualized Return’ page explaining NAR and the differences between adjusted and unadjusted calculations. This is a great resource for those looking to read more about those calculations.

Lending Club Prime Registration Push

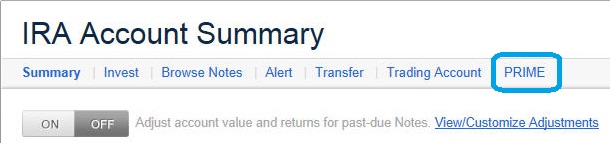

The lesser of the two recent changes for investors, is the addition of a PRIME link to the menu bar of my main investor screen. Lending Club’s PRIME service is an automated investment platform for those with larger accounts. Peter Renton, editor of Lend Academy, has utilized PRIME previously, and has written about it on his site. Feel free to check out his review of the PRIME service and how it works. PRIME operates so that you are allowed to set your investment criteria, customizable at any time, and each business day PRIME will check your account to invest your available funds should there be notes that match your criteria and target allocation. The stated goal of PRIME is to place an order on your behalf at least once a week.

When clicking on the link in my menu bar, Lending Club is currently offering a promotion through the end of 2013 where you can sign up for a PRIME account with an account with a balance of $10,000 or more. Outside of the promotional period you must have a $25,000 account in order for them to take you on as a PRIME customer. Secondly, there is normally a 0.8% fund transfer fee to transition an account over to PRIME. Under this promotion, the transfer fee has been waived. PRIME service can be cancelled or paused at any time according to the promotional materials.

Fortunately, I have two accounts, with one above and below the $10,000 threshold used in the PRIME promotion. As a result, for any of you with less than $10,000 in an account, you will not see the PRIME link in your menu bar.

My Thoughts

Personally, I am a big fan of the continued improvement for investor education and the management of return expectations. I like the current update and will be checking in with it on a regular basis to see how well my accounts age. This update really only applies to accounts not utilized in the active trading of notes, so I would caution anyone looking to this who has been trading and want to compare their returns. This is why I have not included my taxable Lending Club account in the screen shots above.

As for PRIME, I have no interest in rolling my account over. I am a hands-on investor at this point, and enjoy the “chase” so to speak. Additionally, given Peter Renton’s mixed experience with PRIME, I am hesitant to think it is a strong contender for those pursuing higher yields. Now, if you wanted a lower risk account pursuing returns in the 5-7% range, PRIME might be a great hands-off approach and a truly passive means of investing.

What are your thoughts on the changes? Do you like the ability to compare your performance? How do your Lending Club accounts stack up against other investors?

Curious about my Lending Club investments? Check them out on my Lending Club page!

Solid writeup Adam. I’m one of the investors who really doesn’t have a lot to gain from this stuff until they start to include Folio in the calculation. But all the same, its great to see this tool begin. I especially was interested to see the sitewide NAR curve displayed by all these dots.

Couldn’t agree more with you on the NAR curve Simon. Truly represents what the vast majority of investors can expect as their accounts age. Additionally, this is a worthless exercise for my taxable account where I’ve done a tremendous amount of trading in the past.

Thanks for stopping by and commenting Simon!

Hello Adam. I have no experience in the peer lending space, but it interests me very much. From the look of that chart above you can anticipate a return above 10% over the course of your notes. Is that net of fees? I assume this income would be taxed as common interest if it was in a taxable account?

What is PRIME? You mentioned it being hands off and a big push my Lending Club to get people to sign up. What’s their motivation? I’m assuming higher fees resulting in them helping you in some way. Please explain.

-Bryan

For my personal investments, I’d ideally like to achieve in the 10-12% range long-term, however that will be a stretch giving the uncertainty of defaults and the approximately 1% haircut you take from fees. Overall, in looking at the charts you will see that the vast majority of folks will end up in the 5-8% range long-term. Certainly nothing to be disappointed with, however it is best to manage your expectations accordingly.

As for PRIME, it is Lending Club’s own investment advisory service without providing advice. I believe they are working on it to become a much more flexible and customizable investment vehicle so you can easily dictate your own investment criteria. Historically, you were fairly limited in how you could choose to invest with PRIME outside of allocating the dollars into generic “buckets” of high, mid, and low risk notes. For Lending Club, I think they are just using this as a promotion to bring awareness to the upcoming changes in the PRIME offerings. At this point additional investment dollars are not needed as every note gets funded 100% already nor are fees a consideration since they are currently waived. The fees normally are just a one time account conversion fee, not an ongoing haircut. I believe more details regarding PRIME will come out in the next week or so.

Thanks for stopping by Bryan, and I hope I answered your questions.

Excellent coverage! P2P is something I’ve been curious about, but haven’t pulled the trigger yet.

moneycone, I would encourage you to continue to check it out and see if it makes sense for you and your portfolio. I have truly enjoyed investing over the past four years and the returns have been tremendously consistent.

Man, I’m digging these new LC features. Also, your blue dot tells me that you’re kicking really big ass all over the place. Very, very nice returns!

“As for PRIME, I have no interest in rolling my account over. I am a hands-on investor at this point, and enjoy the “chase” so to speak.”

I have not researched PRIME at all yet. I enjoy the chase too, but man, it’s hard to get good loans. I see them fill up in mere seconds!

Are you using any of the other automated investment tools out there?

I am digging them as well Mr. 1500! And thanks you1 My Roth account is still very young, so the true test will occur over the next year as it continues to age and that initial $10,000 investment continues to mature.

Unfortunately I do not think PRIME will be able to compete with the API investors, but we shall see once more information comes out on how they’ve revamped the service. If it proves truly customizable, then it might be worth considering.

As of right now I am not using any automated investment tools, but have simplified my investment criteria a bit to help find good notes. If I were to utilize an automated service at this point, it would be for Prosper, as as I am having more trouble finding available notes for selection there.

Thanks for stopping by!

“…but have simplified my investment criteria a bit to help find good notes.”

Will you be posting on this? Would love to see it.

I will absolutely be sharing it like I shared my original criteria. My plan is to post this sometime in the new year.

The new comparison tool is pretty fun, I just checked it out. I also seem to be an outlier, in a good way, but my NAR is slowly dropping as the months go by. Recently I’ve had a rash of loans hanging out in funding status and never actually issued. Annoying!

Definitely a fun comparison tool, especially for folks who don’t trade their notes and have invested directly. The NAR dropping is pretty standard over time as the notes age, so I wouldn’t worry about that. Nor would I worry about some loans sitting in funding status. Simply a workflow cycle issue for Lending Club at times.

I’m really looking forward to tracking your continued progress with Lending Club. Thanks for stopping by!