We’re now working on the last quarter of 2013 and only six five more catch-up posts left!

Peer to peer lending intrigued me from the moment I first heard about it, and Lending Club is where I first started investing back in 2009. Each month I plan on updating my Lending Club investments in both my taxable and Roth IRA accounts. Nothing is more exciting than watching my investments compound on a regular basis, and Lending Club provides a real-time opportunity to witness this on a monthly basis!

During October, we saw the disappearance of accrued interest from account totals as Lending Club looked to improve how investors view their accounts. Moving into November, Lending Club took even more steps to manage investor’s expectations and two changes really exemplified these changes.

The first change was the introduction of the adjusted net annualized return (ANAR). Utilizing discounted principle values for notes in the grace period through 31-120 days late, Lending Club has attempted to project the loss of capital for late notes with the ANAR. Since I first wrote about it, I have revised my feelings and am a fan of this change as it helps manage unrealistic investor expectations for returns. Poor expectations have sunk many a peer to peer lending investor. One particular shortfall of both the ANAR and original NAR are that they don’t account for accounts where investors have traded notes on the secondary market.

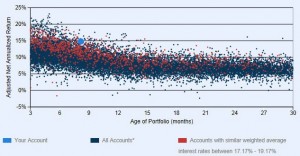

The second change (came in the first week of December) was the creation of an improved investor comparison tool that allows investors to get a sense of what actual overall returns over time are for Lending Club. This is a stark visual reminder (example to right) that returns decay over time as notes underperform. This customizable comparison tool is also able to help show how investors with a similar risk tolerance, based on average interest rate, are performing. Like ANAR above, this comparison tool does not encapsulate the actual returns of those investors trading notes on the secondary market.

The second change (came in the first week of December) was the creation of an improved investor comparison tool that allows investors to get a sense of what actual overall returns over time are for Lending Club. This is a stark visual reminder (example to right) that returns decay over time as notes underperform. This customizable comparison tool is also able to help show how investors with a similar risk tolerance, based on average interest rate, are performing. Like ANAR above, this comparison tool does not encapsulate the actual returns of those investors trading notes on the secondary market.

Going forward, to best reflect these changes, I will be sharing my ANAR for my Roth IRA account, as that account has not been used on the secondary market, as well as my actual NAR and internal rate of return for both accounts, as normal. Now let’s take a look how November turned out.

Roth IRA Account:

With October being a rough month, and severely jeopardizing my ability to hit my 2013 Lending Club net interest goal, it was nice to see a rebound in November. During November, my Roth IRA account earned net interest of $125.98. While not the highest this account has seen, this is right in line with where I expect a “normal” month will be.

As explained above, I will also share my ANAR for this account. With my traditional NAR at 17.11%, the multitude of late notes brings down the ANAR to 14.49%. Of course, this is expected, given my risk tolerance. As of the end of November, my weighted-average interest rate for my invested notes is 17.91%. I say it every month, but I am a realist when it comes to my long-term returns for my peer to peer lending accounts. There will be defaults, charge-offs, and expenses associated with this investment which will adversely affect my returns. I expect my long-term returns to stay in the 12-13% range, but would not be disappointed if I only earned a 10 or 11% return every year.

As explained above, I will also share my ANAR for this account. With my traditional NAR at 17.11%, the multitude of late notes brings down the ANAR to 14.49%. Of course, this is expected, given my risk tolerance. As of the end of November, my weighted-average interest rate for my invested notes is 17.91%. I say it every month, but I am a realist when it comes to my long-term returns for my peer to peer lending accounts. There will be defaults, charge-offs, and expenses associated with this investment which will adversely affect my returns. I expect my long-term returns to stay in the 12-13% range, but would not be disappointed if I only earned a 10 or 11% return every year.

I do not actively trade notes in either of my accounts at this time. Some folks out there utilize the secondary markets to recapture some of the potential losses from late loans prior to default assuming the amount the sell the note for is greater than the overall principle returned prior to default. I do not pursue this strategy as I am attempting to make this as passive of an investment as possible once invested in a note.

My internal rate of return since opening the account, using Excel’s XIRR function, continued to increase as it went from 10.86% to 11.12%. Given that this account has just crossed the year old mark (opened in November of 2012), it is fantastic to have overcome the cash drag and earned over 11%. In just over one year, I’ve earned $1,181.60 in net interest from this account. Now that is a heck of a passive income generator!

Taxable Account:

My taxable account has been fairly steady the last few months with November being no exception. Coming in just under October’s total, I was able to earn $14.03 of net interest. Fortunately, as with last month, this account did not have any defaults or charge offs, and still has just two notes in late status. With luck these notes will come current, or at the least will not go bad prior to the end of the year allowing me a chance to hit my year-end goal.

With another consistent month of net interest, my overall internal rate of return since inception increased from 10.69% to 10.73%. As with the previous month, my weighted average interest rate again increased, going from 15.30% to 15.36%. I would expect this to very slowly continue to increase until somewhere in the 17% range.

Lending Club Summary:

Overall this month was a great rebound from the October’s disappointing results in my Lending Club accounts, bringing in a total of $140.01 in net interest. This was an increase of $13.09 from October’s $126.92 of net interest. As a note, I will need to earn $163.74 of net interest in December in order to hit my 2013 goal. Check out the chart below to see my net interest amounts received by month in 2013.

Isolating the month of November, my overall internal rate of return came out to be annualized 13.89%. This monthly IRR number is extremely variable as my accounts have not achieved a scale where they are insulated against defaults. As I said above, my long-term return projections for my Lending Club investments is in the 12-13% range as defaults, late loans, and uninvested cash drag the returns down from their weighted average.

I have updated my Lending Club page with this information. Please note when tracking my balance and return I do not include the accrued interest in the account, only the interest actually received net of fees, charge-offs, and defaults.

Have questions about peer-to-peer lending? Just ask!

Numbers look good. Steady progress with the update!

-RBD

Thanks RBD! Getting closer to catching up to the present!

Wow, you’ve already made over 2 grand in interest! That’s insane!

Not too shabby, eh?

As a sneak preview to my 2014 goals, I’m aiming for the $2k mark of P2P lending net interest in just one year!

Nice NAR, but that lost 150 plus another 375 at risk is bothersome to me. That effectively lowers your earned interest from 1351.11 down to 826.11 to cover the loss or around that number, correct?

I don’t know, I still miss my edge

I don’t particularly care much for what my NAR return says, and am more concerned with the actual returns. Certainly I have seen some losses, but none of them have been at full value ($25 per note). Of the 15 notes in grace period or late status, I might lose $150-200 of that. Considering the time frame it will take to lose that, I am more than satisfied with my resulting double digit returns.

Charge-offs and defaults are a part of P2P lending, and I have accepted that risk. So at the end of the day, my current losses have been ~$125, and a total of ~$328 more is currently at risk. Again, not all of it will result in a loss of principal.

I know you miss the edge, however I’m sure you must have been aware that the gravy train had to stop at some point? Any company worth anything would eliminate those loopholes which put naïve buyers at an unfair disadvantage.

Appreciate your thoughts and stopping by Martin!

Thanks for the update W2R as I am seeing that I have a bit of catching up to do with LC in learning and seeing all the tools and ways of thinking about it. I started out in 2009 but walked away when I was not liking the trading platform. I’ve returned and am more comfortable with it.

I’m glad you’ve decided to return to P2P lending. There are definitely many more tools available these days. I would highly recommend you take a look at Nickel Steamroller, which has a tremendous amount of resources for investors.